Barely Surviving: How Low-Income Earners Are Struggling for Affordable Housing

Exorbitant rent hikes, unsanitary conditions and barely livable wages are keeping people down.

At the end of each day, Kevin Greggain sets up his bed — a pull-out couch in the tiny living room of his one-bedroom apartment in Ottawa’s west end.

Sometimes, if it’s late and he’s exhausted from a shift at the local grocery store, he won’t even unfold it; instead he’ll just lay down on top of the cushions and close his eyes. In the mornings, he leans over to grab his socks and underwear from the drawer by the sofa where he keeps his clothes.

In the bedroom, his 18-year-old son Thomas sleeps. Greggain tries to do everything he can to put his son first — Thomas has autism and often wants to be alone, which proves difficult when they both live in such close quarters. But Greggain makes it work.

“Sometimes I just end up taking long bus rides, or going on really long walks. I’ll go to the Timmy’s across town, just so he can have some space and enjoy his life,” Greggain says.

Greggain and his son are no strangers to cramped living conditions. In 2017, when Greggain and his ex-partner separated and he got custody of Thomas, the two moved into a small rooming house close by, where they shared a bedroom. When living there became unbearable, Greggain traipsed around Ottawa, knocking on the door of every apartment building he could find.

“I was desperate. When I saw this building, I didn’t hesitate. It’s a really run-down building, so I thought my chances were good enough, and they were,” he says.

At $1,350 per month, around half of Greggain’s monthly minimum wage earnings go to rent, and the rest goes to bills and groceries. On his way to work or on his daily walks, Greggain watches as old buildings are renovated to make space for shiny new condo towers, and he worries that one day, his building will be torn down too.

Support Independent Journalism: Subscribe to The Rover today!

“They’re renovicting people now. My landlord is an independent landlord, but the day he decides to sell to these predatory investment companies is the day that I’m going to face a renoviction myself,” he says. “I fear in the next five years it’ll happen to us too, and we’re all going to be kicked out.”

The average rent in Ottawa for a one-bedroom apartment is $2,044, so Greggain is paying well below market for his unit. He says that the typical one-bedroom apartments he sees would require him to put 80-90 per cent of his monthly income towards rent, and two-bedroom units are pretty much out of the question.

“It’s a looming weight on my shoulders,” he says. “I’m trying to hold all the brunt and the responsibilities. I’m just trying to keep a straight face here, because I don’t want to be all freaked out and angry and upset, and show that kind of fear to my son. I want to try and give him the stability he deserves.”

Greggain isn’t alone. A recent report from the Canadian Centre for Policy Alternatives (CPPA) worked out the “rental wage” in different regions — the hourly wage required to pay rent while working a 40-hour work week, and spending no more than 30 per cent of income on housing. It’s the third year that the CCPA has produced the report, and things only seem to be getting worse.

In Ottawa, where minimum wage is $16.55, the rental wage to afford a one-bedroom is $28.06, and for a two-bedroom is $33.66. That means that Greggain would need to earn more than double his current wage to afford a two-bedroom in his city.

“I serve people food at a grocery store that I can’t even afford to shop at,” Greggain says. “That hurts. That really, really hurts.”

Greggain has thought about leaving the city, but the problem isn’t unique to Ottawa, or even Ontario. In every single province across Canada, the rental wage is considerably higher than the minimum wage.

Kevin Greggain lives in a one-bedroom apartment with his 18-year-old son. The sofa in their living room doubles as Greggain’s bed. PHOTO: Courtesy Kevin Greggain

“We’ve seen a trend where fewer and fewer cities have any options, and any neighbourhoods, that would be affordable for minimum wage workers,” said Ricardo Tranjan, who co-authored the CCPA report.

“Profit maximization seems to be the main driver behind the rent increases, and the government allows it to happen.”

Tranjan says that employers and landlords “double-dip” on low-wage workers — paying them meagre hourly wages and charging exorbitant rent prices.

“If people are spending more than 30 per cent of their income on housing, that leads us to the next question of what other financial sacrifices they’re making as a result,” he says.

“They’re more likely to live in overcrowded housing, and in housing that needs major repairs. It’s not always safe and not always healthy.”

Overcrowded and unhealthy is exactly the kind of housing situation that 35-year-old Ryan Burnham finds himself in. He’s currently completing a three-year graduate nursing degree in Moncton, New Brunswick, and finding housing was hell — the cheapest thing he could find was a $900 room in a unit listed as “student housing.”

When he moved in, he realized that what had once been a three-bedroom home had been sloppily converted into a 12-bedroom house. He currently lives in what he describes as “one-third of a living room.”

“We all work at different times, so there’s constant noise. Everyone tries to be respectful, but it’s a problem,” he says. “I end up doing a lot of my work in the middle of the night.”

Within the first month of living there, Burnham had to deal with a steady stream of maggots coming from his walls. His landlord never replied to any messages for help, and he and his roommates ended up frequently spraying the floor with bleach.

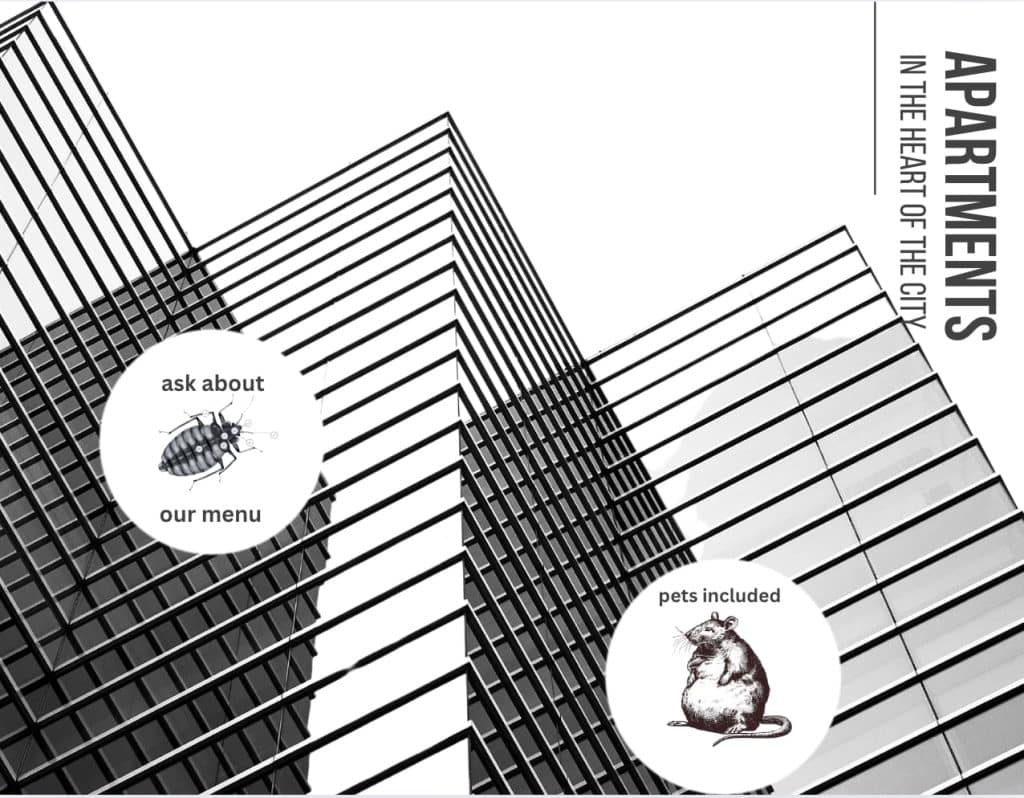

But the maggots were nothing compared to the cockroaches.

“Once I started getting cockroaches in my bedroom, it got to a point where I just kept my lights on full time and slept like that. I would see them on the walls every so often,” he says. “It’s mentally exhausting. Anytime I see something in the corner of my eye now, I just have this habitual reaction.”

Moving out is the obvious solution, but it isn’t easy. Between juggling a part-time job and nursing school, Burnham has little to no time left over to trawl Facebook Marketplace for new listings, and the ones he sees are far above his budget. Most of them are renovated condos, often going for $1,500 to $2,000.

“I don’t understand who this market is for,” he says.

Burnham feels trapped in his housing situation – he simply can’t afford to move out. It’s a common feeling that single mom of two Robyn Boulle can relate to. She lives in Montreal’s Plateau-Mont-Royal borough with her two children, aged six and 12, in a small two-bedroom apartment, which costs $1,650 a month. She dreams of being able to afford something bigger that would give her girls their own space, but it’s not in the cards.

“I wish I could have the space to tell the kids to go downstairs, go to the playroom, but our kitchen and living room is all together, there’s no space. They share a room too, and that’s already a worry,” she says.

Last year, Boulle separated from her partner of 16 years. Throughout her children’s lives until then, she’d been mostly a stay-at-home mom, while her husband continued working, building up savings and climbing up the rungs in his industry. She never thought she’d be scrambling to make ends meet.

“It’s constant panic. It’s like I constantly have a lump right here,” Boulle motions to her throat. “I can’t sleep, I’m just constantly freaking out. Your mood permanently changes, because you’re just so worried about the future. You need a home, and the only thing I want is stability.”

Back in 2018, Boulle and her family had a bigger home — a three-bedroom with garden access for $1,450, less than she’s paying now. But when the landlord said he’d decided to move in his mother, Boulle and her family had to leave.

“Then they turned it into a open-style loft and sold it for like $1.2 million,” she says. “I guess mom found somewhere to live.”

Now, Boulle works part-time doing event bartending. At $18 an hour, she’s happy with the job, but the schedule changes weekly and she’s never sure how many hours she’ll be given. It means that her income is unpredictable, but one thing is easy to predict: she never makes enough to comfortably cover rent. For that, she’s in the uneasy situation of being reliant on financial support from her ex-husband.

“I feel terrible for my ex, I don’t want to keep going like this, but I don’t know what we’re supposed to do. I keep trying to find solutions. All I say to him is ‘I’m going to figure it out somehow,’” she says.

For Boulle, the problem grows alongside her children, as she worries for the future when they need more space and more money for extracurricular activities and school.

Robyn Boulle with her two daughters and a family friend. PHOTO: Isaac Peltz

“I tell them already, they’re going to have to find a good job, because mommy doesn’t have a pension,” she says. “I don’t know how I’m going to live in the future. I literally don’t know what I’m going to do.”

Making ends meet without having paid into a private pension plan is a very real concern.

Sylvia Moscovitz is 76, and she survives on the federal Old Age Security (OAS) pension, as well as her provincial pension. That gives her about $1,400 per month — which is barely enough to cover the $1,012 rent for her one-bedroom apartment in Montreal’s Notre-Dame-de-Grâce, where she’s lived for nine years.

To make sure she has enough to afford bills and groceries, Moscovitz continues to work on contract as an English language tutor. Like Boulle, her hours are also unpredictable and contingent on demand from students.

Some months, rent takes out about 40 per cent of her monthly income.

“I’m looking to my own future. I don’t have kids or grandkids, but I’d worry all the time if I did, because what would I be leaving them?” she says.

Moscovitz used to collect a teacher’s pension, but she cashed it in 46 years ago to pursue her dreams of composing music. She was successful, composing music for the National Film Board and Sesame Street. But she never learned how to save — and she didn’t pay into a pension plan.

“When you’re 29, you’re not looking at the same issues,” she says. “It could often take three months to get paid as a freelancer, so I thought I needed it as a cushion, and that’s why I cashed it in.”

Now, Moscovitz is paying the price. She likes her apartment, but the building isn’t well maintained. She thought about moving into another unit in the building if one came up, but the superintendent has already told her that prices leap up between tenants — he even said that if she were to move, her apartment would be re-listed for $1,600, a nearly 60 per cent increase.

“I’m not going to find anything cheaper,” she says.

Predatory rent increases are the norm across Canada, according to Tranjan.

Between October 2022 and October 2023, 12.5 per cent of rental units in Canada saw a change of tenants. Landlords overwhelmingly increased rent, by an average of 24 per cent. In Toronto, the average rent increase for a new tenant was a whopping 40 per cent.

Provinces have the power to enact and tighten rent control measures — like vacancy controls, which would prevent massive increases before the next tenant when a unit becomes vacant.

“Immediate strengthening of rent controls would have the most needed and concrete impacts for tenants, and that would have the most palpable, immediate impact on housing affordability,” Tranjan says.

Table taken from the Canadian Centre for Policy Alternatives report Out of control rents: Rental wages in Canada, 2023.

The federal government could also intervene — it wouldn’t be the first time. In the mid-1970s, Ottawa persuaded provinces to impose rent controls as an anti-inflation measure. When inflation grew to 12.5 per cent in 1981, rent inflation was just 6.4 per cent. Though rent controls restrained inflation back then, out-of-control rents are only pushing it up today.

“If the federal government really wanted to step in, it could,” Tranjan says. “But it’s chosen not to do it.”

While landlords and private developers grow richer off the backs of low and minimum-wage earners, there’s real people with real lives and real families who are suffering the most — now, and in the future. Unstable housing and cramped living conditions have a daily impact on people’s lives.

“We have absolutely no common area and my room is too small. My girlfriend doesn’t come over, we decided it’s better to just go over to her apartment, because it’s cleaner,” Burnham says. “I don’t have a social life.”

Trips to the foodbank are a weekly occurrence for Burnham, as well as to the blood donation centre, where he gives plasma for cash.

“When I was in school for my undergrad in 2008, it was the financial crash, but it was never this bad,” he says. “I’ve even started taking my antidepressants again.”

For Greggain, nurturing friends and other connections is out of the question. It’s just about making it to the next day.“I can’t have a date. I think I’d be very embarrassed to bring someone here,” he says. “I don’t have anyone to come over. This is my home, and it’s no place to be entertaining people.”

Despite putting on a brave face for his son, Greggain says that most of the time, he feels hopeless.

“I tried so hard, and this is where I’m at,” Greggain tells me with a sigh. “I envy a lot of people around me who drive, who have cottages, who have good jobs, who have a house. I’m jealous of them because I really tried. And I kind of have nothing to show for it.”

Did you appreciate reading this article? Share it with a friend!

I appreciate the story. I had been in a desperately hopeless place well into my late 30s. Fortunately, I have managed to pull myself out but those years have left indelible mark on me. Besides a massive increase in housing supply, there are few other wholesale interventions that would make a meaningful and lasting impact for the financially marginalized.